Whatever car you own, be it a Ford, Nissan, Peugeot or Mercedes, you’re going to need road tax for it. Also known as car tax, vehicle tax or VED (Vehicle Excise Duty), it’s a legal requirement for almost every driver. Unless you fit into the very small list of exceptions, there’s no avoiding it.

Road tax contributes towards road works and the general maintenance of public roads in the UK. We’re here to help you figure out how much VED you need to pay, and when you need to pay it.

Do I Need To Tax My Vehicle?

The majority of car owners in the UK will be required to pay road tax. You’ll be asked to pay this every year for an existing car, or whenever you purchase a new car. Other vehicles, like vans and even motorhomes, are included too.

As we mentioned above, there are a few exemptions. If you match any of the following conditions, you do not have to pay road tax:

- Your vehicle is registered as off-the-road (SORN)

- You own a brand-new car that costs less than £40,000, and also produces 0g of CO2 emissions

- You own a vehicle that’s 40 years old and classified as a “historic vehicle”

- You own a car that produces up to a maximum of 100g of CO2 per km, and was registered between 1 March 2001 and 31 March 2017.

Exemptions may also apply if you have a disability. You may need to get in touch with the DVLA to confirm this, but exemptions include:

- If you receive a War Pensioners’ Mobility Supplement

- If you own a mobility scooter, or something similar

- If you receive the Higher Rate Mobility Component of the Disability Living Allowance

How Much Is Road Tax?

If you’re not exempt, you might be wondering just how much you need to pay when it comes to road tax. The amount due will vary from driver to driver, and largely depends on two key factors: when your vehicle was registered, and what kind of vehicle you own.

To figure out how much you’re required to pay, you’ll need to work out what car tax band your vehicle sits under. Once you’ve found the right band, you can then filter by engine size, fuel type and CO2 emissions.

Cars registered before 1 March 2001

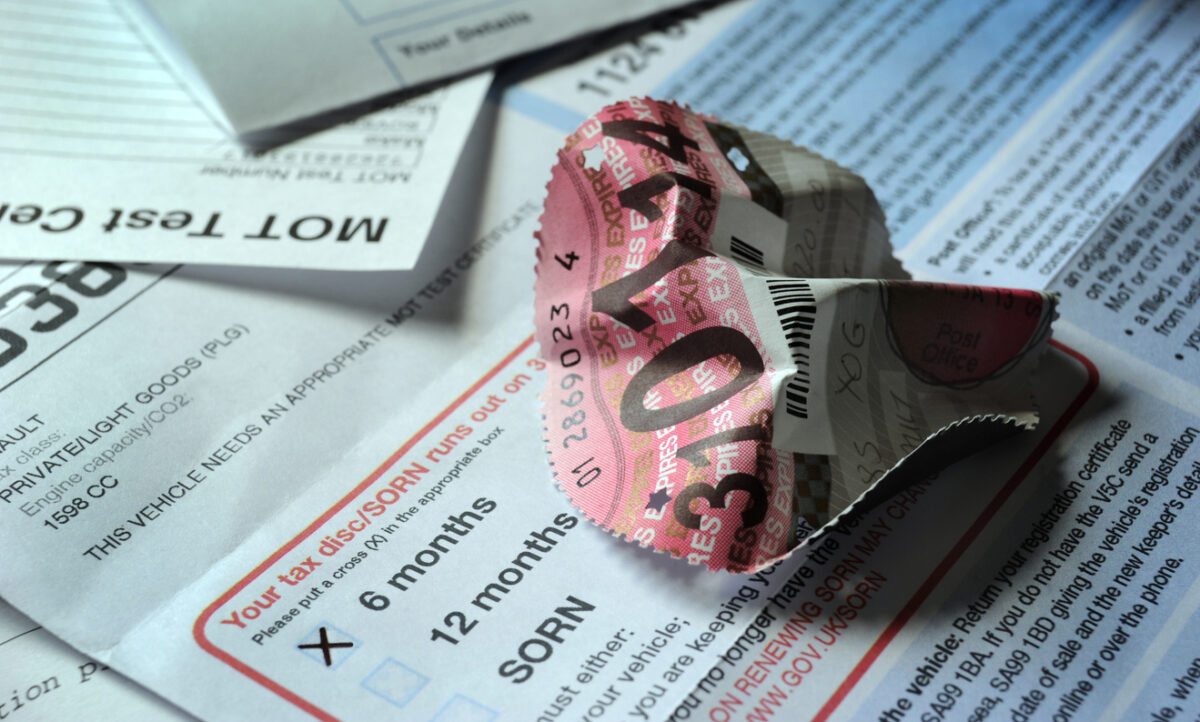

Cars registered before 1 March 2001 are known as PLG vehicles (Private/Light Goods). The system for older cars is simple – it’s all based on engine size.

Cars are split into two categories: under 1549cc and over 1549cc. It’s generally cheaper to pay this by direct debit.

| Under 1549cc | Over 1549cc | |

| Single 12-month payment | £165 | £270 |

| Single 12-month payment via Direct Debit | £165 | £270 |

| Monthly payments for 12 months via Direct Debit | £173.25 | £283.50 |

| Single 6-month payment | £90.75 | £148.50 |

| Single 6-month payment by Direct Debit | £86.63 | £141.75 |

Cars registered after March 2001 and before 1

April 2017

Cars registered after March 2001 but before 1 April 2017 are split into 13 different tax bands. A slightly more complicated system, the easiest way to discover exactly how much you’ll need to pay is to visit the government’s website.

Typically, the lower your car’s CO2 emissions, the lower your tax band will be. Car tax for lower tax bands will be cheaper than higher tax bands.

Cars with CO2 emissions of 100g/km or lower are not required to pay any car tax. Similarly, alternative-fuel cars (such as hybrid cars) benefit from a discount. If you own a car like this, you’ll automatically pay £10 less tax per year than petrol or diesel drivers.

Cars registered after April 2017

Cars registered after April 2017 follow a different set of rules. The first year a car is registered, a payment influenced by the car’s CO2 emissions is required to cover the vehicle for 12 months.

After this, you can choose to pay road tax every 6 or 12 months – at a slightly different rate. Rates are dictated by fuel type, and are visible in an easy-to-understand table on the government website – just click here to calculate your car tax .

In addition to all of the above, separate rates may also apply for different vehicles, such as:

- Vans (classified as light goods vehicles)

- Motorbikes and mopeds

- Tricycles

- Select motorhomes

How Do I Tax My Car?

Taxing your car is a fairly straightforward process, and the easiest way is to apply online. Head to gov.uk/vehicle-tax to get started.

You’ll need to find a reference number to apply and pay road tax. You can find this number on the following documents:

- Your vehicle log book, also known as V5C. This log book must be registered in your name.

- A V11 or ‘last chance’ warning letter from the DVLA

- A ‘new keeper’ slip from the car’s log book if you’ve just bought the car

Alternatively, you can head to your local Post Office and fill out a form in person.

During this process, you can also choose how you’d like to pay car tax. You can tax your car for 6 or 12 months, and you’ll be able to pay it in one lump sum, or split the cost into monthly payments. You can also pay via credit card, debit card or – if choosing instalments – via direct debit.

Can I Tax My Car Without Car Insurance Or A Valid MOT?

Before you tax any vehicle, you’ll need to make sure it’s insured – and has a valid MOT – first. All three are required by law, and the DVLA will check this when you apply for road tax.

How Can I Check If My Car Is Already Taxed?

Checking if a car has been taxed, or when car tax is next due, is really simple. All you need is your car’s registration number – type it into this car tax checker, and you’ll instantly have your answer.

If you’ve bought a new car, you’ll need to pay car tax for it, even if you’ve paid car tax for a different vehicle within the same year. Payments are not transferrable between vehicles.

If the car is brand-new, your dealership may pay your first year’s car tax for you. It’s important to check if this is included in the final price to avoid paying twice. Trusted dealers selling second-hand vehicles should also be able to help you organise car tax.

When Should I Renew My Road Tax?

You’ll automatically receive a reminder when your car tax is due to expire, so there’s no need to worry. This will either occur every 6 or 12 months – depending on the option you selected when you first applied to pay car tax for the vehicle.

For example, if your car is taxed for 12 months from 1st February, you’ll receive a reminder just before the end of January.

If you’ve decided to pay via direct debit, your road tax will renew automatically. You’ll receive an email or letter from the DVLA to inform you that the renewal will take place, rather than a V11 letter.

Whether you need replacement parts for your car, or cleaning and detailing products, don’t forget to take a look at the huge collection of car parts and accessories available here at Euro Car Parts. Alternatively, you can always head to a Euro Car Parts store – there are more than 250 across the country.